Financial Capability Policy

Assessment of financial capability under the Mineral Resources (Sustainable Development) Act 1990

1 Objectives and principles

This operational policy sets out the factors that will be considered by the Minister for Resources (or delegate) in assessing a licence applicant’s or existing licence holder’s financial capability associated with exploration, retention, mining and prospecting licence applications under the Mineral Resources (Sustainable Development) Act 1990 (MRSDA).

The term ‘applicant’ is used throughout this operational policy document to describe an applicant for a licence or an existing licence holder when applying for renewal of a licence.

The overall objectives of this operational policy are to:

- Enable licence applicants with the financial capability necessary to conduct effective exploration and mining projects to be granted exclusive access to the State’s earth resources or provide opportunities for other prospective entrants who can, thereby generating investment and job opportunities in regional areas,

- Provide assurance for land holders, government and the wider community that licence applicants will fulfil their regulatory obligations to protect people, land, infrastructure and the environment throughout the exploration and mining life cycle, including site rehabilitation;

- Enable robust, informed decisions about licence applicants’ financial capability to meet their statutory requirements

- Provide upfront guidance to all licence applicants about how applications will be assessed in a transparent, fair and consistent way, particularly noting that:

- a licence application may be granted if an applicant is likely to fulfil the financial requirements to hold a licence

- a licence application may be refused if an applicant is unlikely to fulfil the financial requirements to hold a licence,

- if a licence is granted, the financial capability provisions must be met on a continuous basis for the duration of a licence, noting that a licence may be cancelled if a licensee is no longer considered to be able to meet the minimum financial obligations of the licence, and

- an application to renew a licence may be refused if a licensee is no longer considered to be able to meet the minimum financial obligations of the licence.

This operational policy applies to all licence applicants and related parties of the applicant that may be relied upon to meet the financial capability criteria. A related party means a controlling entity (e.g. parent company), a director or relative of a director, an entity that is controlled by a related party or an entity acting in concert with a related party.

2 Financial capability

2.1 General concepts

Financial capability is the ability for a licensee to deliver on their financial obligations over the life of a licence. This includes but is not limited to:

- undertaking the proposed expenditure to conduct works on the site under licence;

- conducting works activities on a site in line with the agreed work program;

- rehabilitation of the site to the extent required for further licensing and development.

All applicants are required to submit a minimum level of evidence to support their financial capability to fund the minimum expenditure required for the maintenance of their licence and rehabilitation, as per regulations 13(e), 14(e), 15(f), 16(f) and 17(f)(iv) of the Mineral Resources (Sustainable Development) (Mineral Industries) Regulations 2019 (‘MRSD Regulations’).

For new applicants, the following website pages detail the financial information required to be submitted with a licence application:

- Exploration licence application kit

- Retention licence application kit

- Mining licence applicaiton kit

- Prospecting licence application kit

Earth Resources Regulation may request further financial information to support an application.

3 Relevant legislation

Section 15(6)(d) of the MRSDA requires that: An applicant for a licence must satisfy the Minister that the applicant is likely to be able to finance the proposed work and rehabilitation of the land.

Applicants for an exploration, retention, mining or prospecting licence must demonstrate that they are likely to be able to meet the minimum financial obligations of a licence.

This requirement is ongoing for the life of a licence:

- An application for the renewal of a licence may be refused if the licence holder is no longer likely to be able to finance the proposed work and rehabilitation of the land (Section 31(2));

- An existing licence may be cancelled at any time if the licence holder is no longer likely to be able to finance the proposed work and rehabilitation of the land (Section 38(1)).

4 Financial capability assessment

4.1 Assessing expenditure and rehabilitation amounts

The following factors will be considered when assessing a licence applicant’s financial capability:

- Estimated work program costs – Earth Resources Regulation will estimate the minimum likely cost of completing the first two years of the work program that is the subject of the application:

- Exploration, Prospecting, and Retention licences: Earth Resources Regulation has a number of methods that can be used to estimate this expenditure, including Expenditure Rates.

- Mining licences: work program costs for mining licences will be assessed on a case-by-case basis and Earth Resources Regulation may require additional information from the applicant to make this assessment.

- Estimate rehabilitation costs – Earth Resources Regulation will estimate the likely cost of rehabilitating the land that is the subject of the application. The regulator has a number of methods for calculating the estimated costs of rehabilitation.

- Rehabilitation costs for mining licences will be assessed on a case-by-case basis and the regulator may require additional information from the applicant to make this assessment.

- All relevant tenements – the regulator will include in their financial capability assessment the work program and rehabilitation costs for all tenements already held by an applicant.

- Other costs – the regulator will include any other relevant costs, such as annual rent and royalties.

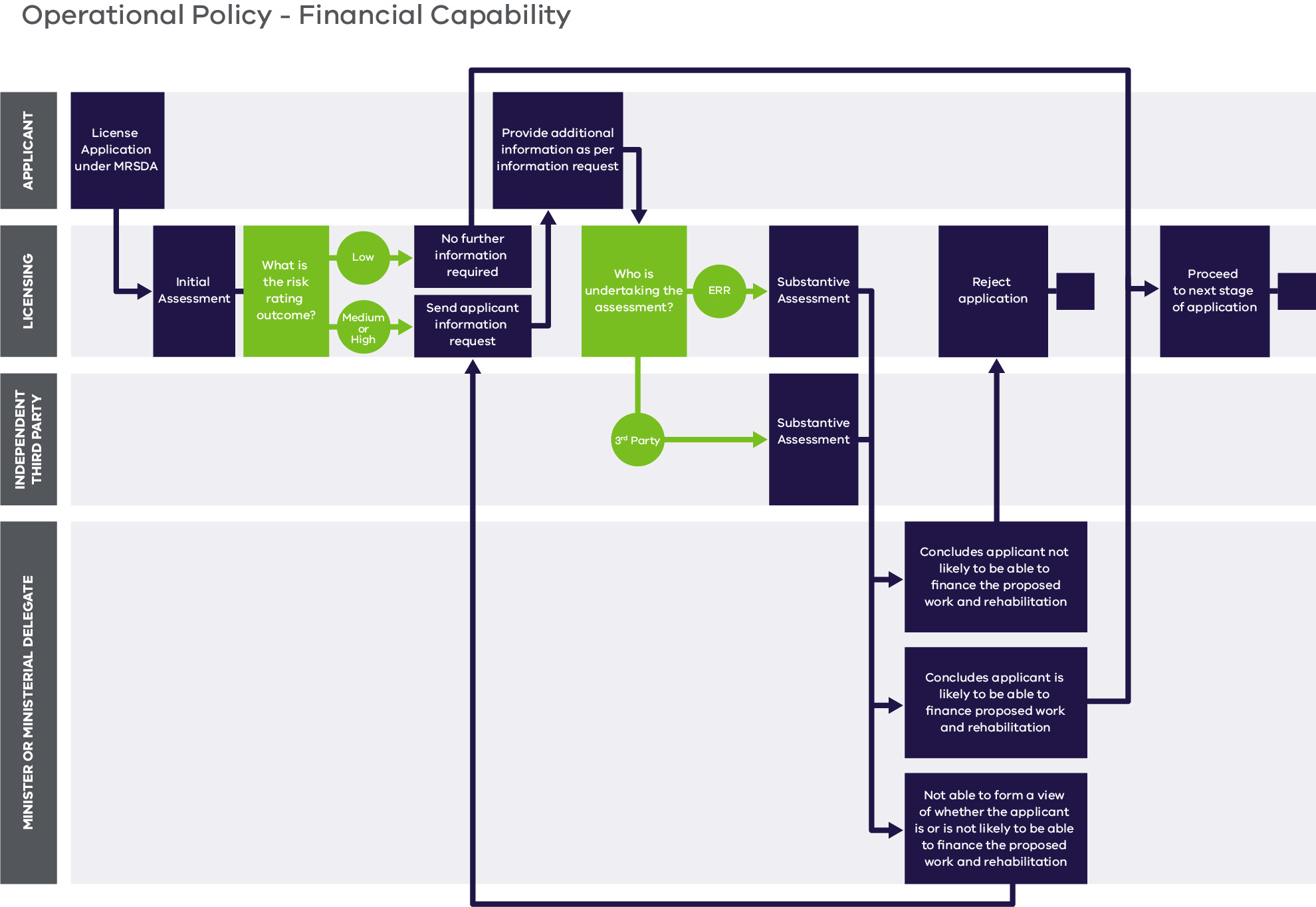

4.2 Assessment process

Each licence applicant will be subject to an assessment process to determine their financial capability to undertake the works and rehabilitation for the licence for which they have applied.

The assessment process will include an Initial Assessment (see 4.3) and a Substantive Assessment (see 4.4).

The level of detail required under the Substantive Assessment will be determined by a risk-rating process completed as part of the Initial Assessment.

4.3 Initial Assessment

Earth Resources Regulation will conduct financial assessments in a way that is commensurate with the scale, scope and relative risk of tenement. Consequently, the timing and the extent of financial capability assessments should be determined based on the relative risk of the licence and the applicant.

The regulator will complete an Initial Assessment to determine whether an applicant and/or application is to be considered low, medium or high risk. This Initial Assessment will determine how detailed the Substantive Assessment required under Section 4.4 of this policy will be.

4.3.1 Risk rating

Earth Resources Regulation will characterise each application as low, medium and high-risk based on a number of quantitative and qualitative factors, including but not limited to:

- The quantum of expenditure and works required for the tenement;

- The complexity of determining the estimated cost for works and rehabilitation for the tenement;

- The applicant’s unfettered access to security and/or funds where reliant on financial support from another entity or source

; - The history of the applicant’s financial conduct with the regulator, such as timely payment of fees, rent and royalties.

4.3.2 Analysis

The Initial Assessment will be completed using documents provided by the applicant when their application(s) are submitted. The minimum financial information to be supplied with an applicant’s application is detailed at the sites listed in Section 2.1.

4.3.3 Outcome of Initial Assessment and information request

The level of Substantive Assessment required will be defined by the result of the Initial Assessment.

The outcome of the Initial Assessment will consequently also determine the information that applicants are likely to be required to provide:

- Where the regulator has determined an application is low risk, no further information will be required to be produced by the applicant to evidence their financial capability.

- Where the regulator has determined an application is medium or high risk, additional information is likely to be required to be provided by the applicant. In addition, the regulator may engage an independent third party expert to assist with the financial capability assessment.

4.4 Substantive Assessment

The regulator will complete the Substantive Assessment following the Initial Assessment and the applicant’s response to the information request (if relevant).

The purpose of the Substantive Assessment is to determine whether an applicant is likely to be able to finance the proposed work and rehabilitation of the land.

4.4.1 Analysis

The Substantive Assessment will be completed using:

- Information provided in the initial application;

- Information provided in response to the information requests;

- Publicly available information; and

- Any further documents provided by the applicant when their application(s) are submitted.

4.4.2 Outcome of Substantive Assessment

At the conclusion of the Substantive Assessment, a view will be formed on whether an applicant is likely to be able to finance the proposed work and rehabilitation of the land.

The potential outcomes of the Substantive Assessment are:

- the application will be progressed to the next stage of the application process if the applicant is likely to be able to finance the proposed work and rehabilitation of the land

- the application may require a further information request and/or be referred to an independent assessor who is an expert in financial viability assessments where it has not been possible to form a view on whether the applicant is or is not likely to be to finance the proposed work and rehabilitation of the land

- the application will be refused where the applicant is not likely to be able to finance the proposed work and rehabilitation of the land.

5 General procedures

Procedural fairness

All applicants will be subject to the Initial Assessment and Substantive Assessment process for assessment of their financial capability when applying for a licence under the MRSDA and supporting Regulations.

Applicants will be given an opportunity to explain any relevant matter.

Applicants will be informed in writing of any decision and the reasons for the decision with respect to their status as a financially viable applicant for the licence in consideration.

Request for further information

Applicants are required to submit current and accurate information to inform the assessment of their status as a financially viable applicant for the licence in consideration. Applicants may also be requested to submit updated information to inform the assessment of their continuing status as a financially capable applicant.

A financial capability assessment under MRSDA 15(6)(d) may be undertaken by the regulator at any time, including once a licence has been renewed or granted. Further information may be required where the applicant has specific or complex circumstances, including but not limited to those addressed in section 2.1.

Earth Resources Regulation will conduct financial capability checks, company searches and other relevant inquiries, and use its official record of previous dealings with the applicant to verify and inform the assessment of their status as a financially capable applicant to hold their licence. The applicant’s consent will be sought where necessary.

Any requests for further information will be sent in writing (letter or email) to the applicant. Correspondence to applicants will indicate the timeframe for providing supporting evidence. This is usually 14 to 28 days and applicant may be granted additional time to provide information if reasonably required.

Requests for further information will be based on the particulars of the application, but may include:

- additional or more recent financial statements and

- details of proposed or previous successful capital raising activities

An application may be refused or a licence cancelled if an applicant fails to provide sufficient information to enable the assessment of whether they are financially viable.

Rights of Appeal

Licensing decisions may be judicially reviewed by the Supreme Court of Victoria: https:/www.supremecourt.vic.gov.au

A dispute may also be brought to the Mining Warden for resolution prior to a licensing decision being made. The Mining Warden is an independent statutory office holder appointed by the Governor in Council under the Mineral Resources (Sustainable Development Act) 1990 who investigates and attempts to resolve disputes by mediation, conciliation or arbitration, including between a licensee or an applicant for a licence and the regulator.

6 Relevant legislation

Section 15(6) - MRSDA

- An applicant for a licence must satisfy the Minister that the applicant is likely to be able to finance the proposed work and rehabilitation of the land.

Section 31(2) - MRSDA

The Minister may refuse to renew a licence if the Minister is satisfied as to any one or more of the following matters—

- the applicant as a licensee no longer complies with section 15(6)(a), (b), (ba), (c) or (d);

Section 38(1) - MRSDA

The Minister may cancel a licence, by instrument served on the licensee, if—

- the Minister has given the licensee 28 days' written notice of his or her intention to cancel the licence and has, in that notice, requested the licensee to provide reasons why the licence should not be cancelled; and

- subject to subsection (1A), the licensee no longer complies with section 15(6)(a), (b), (ba), (c) or (d)

Glossary of terms

| Term | Definition (as relating to this document) |

|---|---|

| DJPR or the Department | Department of Jobs, Precincts and Regions |

| Minister | Minister for Resources (or Ministerial delegate) |

| MRSDA | Refers to the Mineral Resources (Sustainable Development) Act 1990 |

| Regulations | Refers to the Mineral Resources (Sustainable Development) (Mineral Industries) Regulations 2019 |

| State | The State of Victoria, Australia |

Page last updated: 26 Jan 2023